This article explores luxury jewelry pieces that not only exude elegance but also maintain their value, making them wise investments for collectors and enthusiasts alike. Investing in jewelry is not merely about aesthetics; it’s about understanding the market dynamics and the intrinsic value of the pieces. Here, we delve into the top ten luxury jewelry items that are not only beautiful but also serve as sound investments.

Jewelry can be a lucrative investment if you know what to look for. Factors such as rarity, brand reputation, and market trends play significant roles in determining the value of a piece. Additionally, the craftsmanship and materials used can enhance the investment potential of jewelry.

Diamonds have long been regarded as a symbol of wealth and status. Their rarity and enduring appeal make them a solid investment choice for jewelry enthusiasts. The value of diamonds is largely determined by the 4Cs: cut, color, clarity, and carat weight.

Gold jewelry has historically been a reliable investment due to its intrinsic value and demand in both the jewelry and commodities markets. Investing in solid gold pieces or gold bullion can provide stability in an investment portfolio.

Luxury watches from renowned brands often appreciate over time, making them both functional items and investment pieces for collectors. Brands like Rolex and Patek Philippe are known for their high resale values.

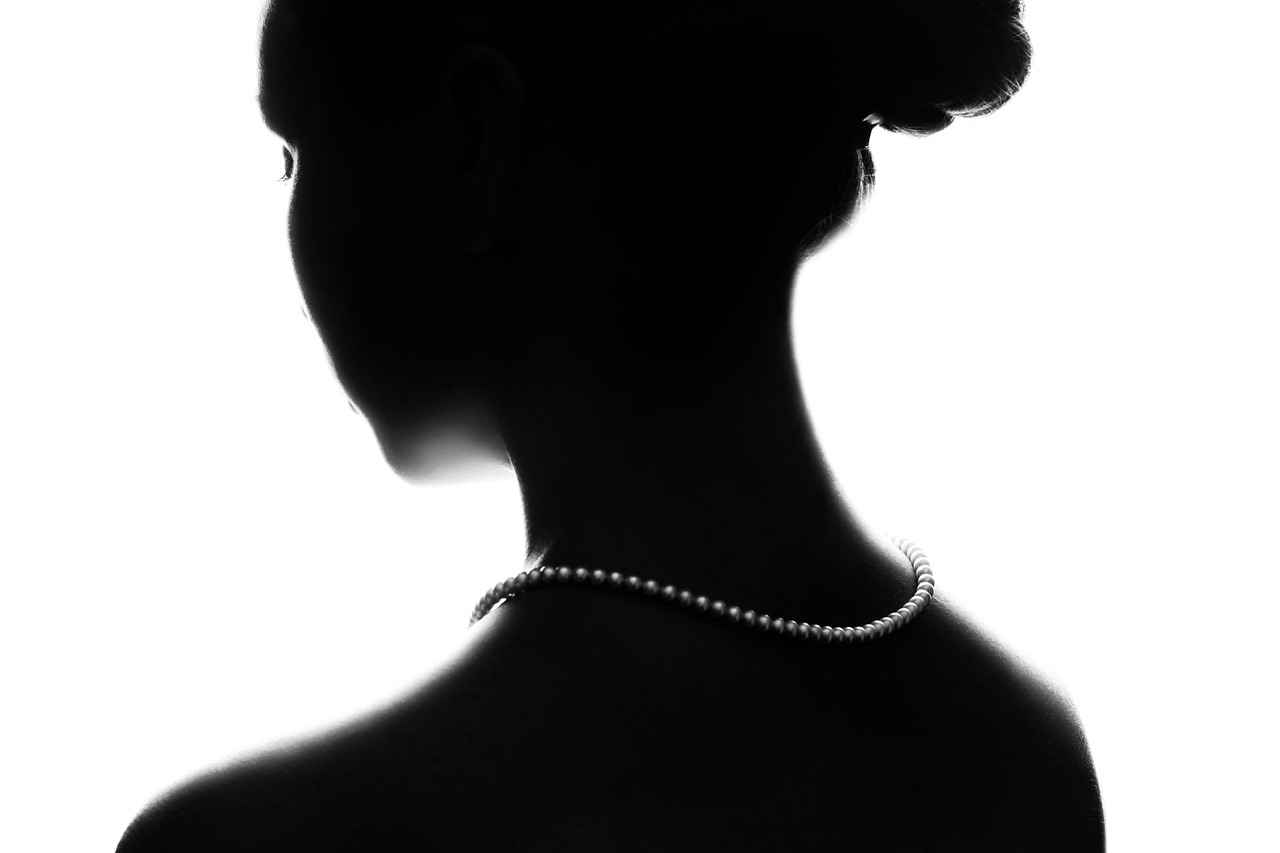

Fine pearls, particularly high-quality cultured pearls, can hold significant value and appeal to discerning collectors. Understanding the different types of pearls, such as Akoya, South Sea, and Tahitian, can help investors make informed decisions.

Emeralds are not only stunning but also increasingly sought after, making them a valuable addition to any jewelry collection. The quality of emeralds is assessed based on color, clarity, cut, and carat weight, all of which significantly impact their market value.

Antique and vintage jewelry pieces often carry historical significance, making them unique investments that can appreciate over time. Knowing how to identify authentic antique jewelry can help collectors avoid counterfeit pieces and ensure their investments are genuine.

Colored gemstones, such as sapphires and rubies, are gaining popularity as investment pieces due to their rarity and beauty. Certain colored gemstones have shown a history of price appreciation, making them appealing options for investors looking to diversify their jewelry collections.

Custom and designer jewelry pieces often carry unique value due to their craftsmanship and brand recognition. Investing in pieces from well-known designers can enhance the resale value of jewelry, as brand reputation plays a significant role in the luxury market.

In conclusion, understanding the nuances of each type of jewelry can empower investors to make informed decisions. Whether you are drawn to the allure of diamonds, the stability of gold, or the charm of vintage pieces, there is a wealth of opportunities in the luxury jewelry market.

What Makes Jewelry a Good Investment?

When considering the world of jewelry, it’s essential to recognize that not all pieces are created equal in terms of investment potential. Understanding the factors that contribute to the investment potential of jewelry can empower buyers to make informed decisions and truly appreciate the value of their collections.

One of the most significant factors influencing jewelry’s investment potential is its rarity. Limited production runs or unique designs can create a sense of exclusivity, driving up demand. For instance, pieces featuring rare gemstones or limited-edition collections often appreciate in value over time.

The craftsmanship of a jewelry piece is another critical element that affects its investment potential. High-quality materials and meticulous artistry not only enhance the visual appeal but also contribute to the longevity and durability of the piece. Buyers should look for signs of superior craftsmanship, such as precise settings and the absence of imperfections.

Investing in jewelry from renowned brands can significantly impact its resale value. Well-established luxury brands, such as Cartier or Tiffany & Co., have a history of maintaining their value due to their reputation for quality and exclusivity. Collectors often seek pieces from these brands, knowing they are investing in a legacy.

Keeping abreast of market trends is crucial for any jewelry investor. The demand for certain styles, materials, or gemstones can fluctuate based on cultural shifts, fashion trends, and economic conditions. For example, the rising popularity of ethical jewelry has led to increased interest in sustainable practices within the industry, affecting the value of such pieces.

While financial considerations are paramount, the emotional value of jewelry should not be overlooked. Many buyers invest in pieces that hold sentimental significance, such as heirlooms or gifts from loved ones. This emotional connection can enhance the perceived value, making the jewelry more than just a financial asset.

The condition of jewelry plays a pivotal role in its investment potential. Well-maintained pieces are more likely to retain their value. Regular cleaning, proper storage, and timely repairs can help preserve the integrity of the jewelry. Buyers should also consider the potential costs of maintenance when evaluating their investment.

Investors should consider diversifying their jewelry collections to mitigate risk. This can include a mix of different types of jewelry, such as vintage pieces, modern designs, and various gemstones. By spreading investments across various categories, collectors can better navigate market fluctuations and increase their chances of long-term appreciation.

Having proper documentation and provenance for jewelry pieces can significantly enhance their value. Certificates of authenticity, appraisals, and historical records provide buyers with assurance regarding the quality and origin of the piece. This transparency is particularly important for high-value investments.

In summary, understanding the multifaceted factors that contribute to the investment potential of jewelry is essential for both seasoned collectors and new buyers. By considering rarity, craftsmanship, brand reputation, market trends, emotional value, condition, diversification, and documentation, investors can make informed choices that not only enhance their collections but also provide lasting value.

Diamonds: The Timeless Classic

Diamonds are often celebrated not just for their breathtaking beauty but also for their significant role in the luxury jewelry market. These stunning gems have been cherished throughout history, serving as a timeless symbol of wealth and status. Their unique properties, including rarity and enduring appeal, make them a preferred choice for investors and jewelry enthusiasts alike.

Investing in diamonds can be a lucrative choice for several reasons. Firstly, their limited supply and high demand contribute to their value retention over time. Unlike many other commodities, diamonds do not depreciate in value as quickly, making them a stable asset for those looking to diversify their investment portfolio.

Understanding the grading system for diamonds is crucial for any potential investor. The 4Cs—cut, color, clarity, and carat weight—determine a diamond’s quality and, consequently, its market value. A well-cut diamond will reflect light beautifully, while those with higher clarity and color grades are rarer and more sought after. Investors should familiarize themselves with these criteria to ensure they are making informed purchases.

Keeping abreast of current market trends is essential for maximizing investment potential. The diamond market can be influenced by various factors, including economic conditions, fashion trends, and even geopolitical events. For instance, during times of economic uncertainty, luxury items like diamonds may see fluctuations in demand. Investors should monitor these trends closely to identify optimal times for buying or selling their diamond jewelry.

With the rise of lab-grown diamonds, many investors are questioning whether these alternatives hold the same value as natural diamonds. While lab-grown diamonds are often more affordable, they typically do not appreciate in value like their natural counterparts. Investors should consider their long-term goals and the potential resale market when deciding between the two.

Proper care and maintenance of diamond jewelry is vital to preserving its beauty and value. Regular cleaning, safe storage, and avoiding exposure to harsh chemicals can help maintain the diamond’s brilliance. Additionally, having pieces professionally evaluated and maintained can ensure their longevity and market value.

Diamonds remain a classic investment choice for those looking to combine beauty with financial security. Their unique qualities, coupled with a thorough understanding of grading and market trends, can empower investors to make savvy purchasing decisions. As with any investment, thorough research and careful consideration are key to maximizing the potential returns on diamond jewelry.

Understanding Diamond Grading

When it comes to investing in diamonds, understanding the grading system is essential for making informed decisions. The diamond grading system is primarily based on the 4Cs: cut, color, clarity, and carat weight. Each of these factors plays a significant role in determining a diamond’s overall quality, desirability, and market value.

- Cut: This refers to how well a diamond has been shaped and faceted. A well-cut diamond reflects light beautifully, enhancing its brilliance and sparkle. The cut is often considered the most important of the 4Cs.

- Color: Diamonds come in a variety of colors, but the most valuable ones are colorless or near-colorless. The grading scale ranges from D (colorless) to Z (light yellow or brown). The less color a diamond has, the more valuable it typically is.

- Clarity: This measures the presence of internal or external flaws, known as inclusions and blemishes. Clarity is graded on a scale from Flawless (no inclusions visible under 10x magnification) to Included (inclusions visible to the naked eye).

- Carat Weight: This refers to the weight of the diamond, with one carat equal to 0.2 grams. Larger diamonds are rarer and thus more valuable, but carat weight should be considered alongside the other Cs for a comprehensive evaluation.

The grading of diamonds is crucial for several reasons:

- Value Determination: The 4Cs directly influence a diamond’s market price. Understanding these factors helps buyers assess whether they are paying a fair price.

- Investment Potential: Diamonds graded highly on the 4Cs are more likely to appreciate in value over time. Investors should prioritize diamonds with excellent cut, color, and clarity.

- Market Demand: The desirability of diamonds can fluctuate based on trends in the jewelry market. Graded diamonds often maintain their value better than those without certification.

When purchasing a diamond, it is crucial to choose one that comes with a reputable certification from recognized grading organizations such as the Gemological Institute of America (GIA) or the American Gem Society (AGS). These certifications provide an unbiased assessment of the diamond’s quality based on the 4Cs.

Many buyers fall prey to misconceptions regarding diamond grading:

- More Carats Equals Better Value: While larger diamonds are often more valuable, quality should not be sacrificed for size. A smaller diamond with superior cut, color, and clarity can be more desirable.

- Colorless Diamonds Are Always Best: While colorless diamonds are highly sought after, some buyers may prefer fancy colored diamonds, which can also hold significant value.

In summary, understanding the diamond grading system is vital for anyone looking to invest in diamonds. By familiarizing oneself with the 4Cs and the importance of certification, buyers can make educated decisions that align with their investment goals. The world of diamonds is intricate, but with the right knowledge, anyone can navigate it successfully.

Market Trends for Diamonds

In the world of luxury investments, diamond jewelry stands out as a timeless choice. Understanding the market trends for diamonds is crucial for investors who want to make informed decisions about buying or selling these precious gems. By keeping a close watch on current trends, investors can optimize their investment potential and ensure they are making the most of their financial resources.

Market trends provide insights into the demand and value of diamonds. Fluctuations in the market can indicate the best times to buy or sell, allowing investors to maximize their returns. For instance, if the demand for diamonds increases due to a rise in consumer interest or marketing campaigns, prices may surge, making it a prime time to sell.

- Supply and Demand: The basic economic principle of supply and demand heavily influences diamond prices. Limited supply combined with high demand can drive prices up.

- Market Sentiment: Consumer preferences can change over time. For example, a shift towards ethically sourced diamonds can impact the market.

- Global Economic Conditions: Economic stability or instability can affect luxury spending. During economic downturns, luxury items like diamonds may see a drop in demand.

As of late 2023, several trends have emerged in the diamond market:

- Sustainable Diamonds: There is a growing preference for lab-grown diamonds and ethically sourced stones. This trend reflects a shift in consumer values towards sustainability.

- Customization: Personalized diamond jewelry is gaining popularity, with consumers seeking unique pieces that reflect their individual style.

- Investment in Colored Diamonds: Fancy colored diamonds are becoming increasingly sought after, often appreciating in value more than traditional white diamonds.

Investors should consider subscribing to industry reports, following reputable diamond dealers, and engaging with online forums dedicated to jewelry investments. These resources can provide timely updates on market shifts and emerging trends.

Timing is everything in the diamond market. Here are some indicators to consider:

- Market Reports: Regularly review market reports to identify pricing trends and consumer behavior.

- Seasonal Trends: Certain times of the year, such as holidays or wedding seasons, can influence demand for diamond jewelry.

- Economic Indicators: Keep an eye on economic forecasts that might affect consumer spending in luxury markets.

By staying informed and understanding the intricacies of the diamond market, investors can make strategic decisions that enhance their investment portfolios. Whether you’re looking to buy or sell, knowledge of current trends can pave the way for successful transactions in the world of diamond jewelry.

Gold Jewelry: A Stable Asset

Gold jewelry has long been regarded as a stable asset in the world of investments. Its intrinsic value, derived from the metal’s rarity and historical significance, makes it a reliable choice for collectors and investors alike. Unlike many other commodities, gold has maintained a consistent demand in both the jewelry and commodities markets, making it a sought-after investment.

The intrinsic value of gold stems from its limited supply and the high costs associated with mining and refining it. This scarcity ensures that gold retains its value over time, even during economic downturns. Additionally, gold has been used as a form of currency and a store of value for centuries, further solidifying its status as a reliable investment.

The demand for gold jewelry is consistently high, driven by cultural significance, fashion trends, and investment potential. In many cultures, gold jewelry is not only worn for aesthetic appeal but also serves as a symbol of wealth and status. This cultural importance contributes to its ongoing demand, making it a desirable asset for investors.

- Solid Gold Pieces: These are made entirely of gold and are typically valued based on their weight and purity.

- Gold Bullion: Gold bars and coins are a direct investment in gold, often favored for their liquidity and ease of storage.

- Designer Items: Pieces from renowned designers can appreciate significantly due to their craftsmanship and brand recognition.

The purity of gold is measured in karats, with 24K being pure gold. The higher the karat, the more valuable the piece tends to be. Investors should be aware that while lower karat gold may be more durable, it also contains less gold content, impacting its overall value. Understanding the purity of gold jewelry is crucial for making informed purchasing decisions.

Gold prices fluctuate based on various factors, including economic conditions, inflation rates, and geopolitical stability. Keeping an eye on these trends can help investors determine the best time to buy or sell their gold jewelry. Additionally, seasonal demand, particularly during holidays and wedding seasons, can influence prices, creating opportunities for savvy investors.

Incorporating gold jewelry into an investment portfolio can provide a hedge against inflation and market volatility. As a tangible asset, gold offers a sense of security, especially during uncertain economic times. Investors should consider allocating a portion of their portfolio to gold jewelry as a means of diversification, balancing risk with potential returns.

To maintain the value of gold jewelry, proper care and maintenance are essential. Regular cleaning, safe storage, and avoiding exposure to harsh chemicals can help preserve the luster and integrity of the pieces. Additionally, obtaining appraisals and keeping records of purchases can assist in tracking the value over time.

In summary, gold jewelry stands out as a stable asset in the investment landscape. Its intrinsic value, consistent demand, and cultural significance make it a wise choice for collectors and investors alike. By understanding the various types of gold jewelry, market trends, and preservation techniques, individuals can make informed decisions that enhance their investment portfolios.

Types of Gold Jewelry to Consider

When it comes to investing in gold jewelry, it’s essential to understand the various types available, as each offers distinct advantages and value propositions. This section will delve into three primary categories of gold jewelry: solid gold pieces, gold bullion, and designer items. By exploring these options, investors can make informed decisions that align with their financial goals and personal tastes.

Solid gold jewelry refers to items made entirely of gold, without any fillers or alloys. These pieces are typically marked with a karat designation, indicating their purity. For instance, 24-karat gold is considered pure gold, while 18-karat gold contains 75% gold and 25% other metals. Investing in solid gold jewelry is advantageous due to its intrinsic value, as it can be melted down and sold for its gold content. Additionally, solid gold pieces often have a timeless appeal, making them desirable for both personal use and resale.

Gold bullion is another popular investment option, typically available in the form of bars or coins. Unlike jewelry, bullion is primarily valued based on its weight and purity rather than craftsmanship or design. Investors often prefer bullion for its liquidity, as it can be easily bought and sold in the market. Popular bullion coins, such as the American Gold Eagle or the Canadian Gold Maple Leaf, are recognized worldwide, making them a reliable choice for investors looking to diversify their portfolios. The price of gold bullion fluctuates based on market conditions, so staying informed about these trends is crucial for maximizing investment potential.

Designer gold jewelry combines artistry with investment value. Pieces created by renowned designers often carry a premium due to their craftsmanship, brand recognition, and limited availability. Investing in designer items can yield significant returns, especially if the piece becomes a collector’s item over time. However, it’s essential for investors to research the designer’s reputation and the piece’s provenance to ensure authenticity and value. Popular designers, such as Cartier, Tiffany & Co., and Van Cleef & Arpels, have a proven track record of maintaining high resale values in the luxury market.

By diversifying investments across different types of gold jewelry, investors can mitigate risks and enhance their potential for returns. Solid gold pieces offer stability and intrinsic value, while gold bullion provides liquidity and market responsiveness. Meanwhile, designer items contribute uniqueness and potential appreciation based on brand prestige and rarity. Understanding these distinctions allows investors to tailor their collections to their financial objectives and personal preferences.

When considering investments in gold jewelry, it’s crucial to evaluate several factors:

- Purity: Check the karat rating to understand gold content.

- Market Trends: Stay updated on gold prices and demand in the jewelry market.

- Condition: Assess the condition of the jewelry, as wear and tear can affect value.

- Provenance: For designer items, verify the authenticity and history to ensure value retention.

In conclusion, exploring the different types of gold jewelry, including solid gold pieces, gold bullion, and designer items, provides investors with a comprehensive understanding of their options. Each type offers unique benefits, making it essential for potential buyers to consider their investment strategy carefully.

The Role of Gold Purity

Gold purity is a critical factor in determining the value and desirability of gold jewelry. Measured in karats, this purity level reflects the proportion of pure gold present in an item compared to other metals, such as silver or copper, that may be alloyed with it. Understanding the significance of gold purity can greatly enhance a collector’s ability to make informed purchasing decisions.

Gold is typically categorized into several purity levels, including:

- 24K – This is the highest purity level, consisting of 99.9% pure gold. It is often used in high-end jewelry and investment products.

- 22K – Comprising 91.6% pure gold, 22K gold is common in fine jewelry, particularly in Asian markets.

- 18K – With 75% pure gold, 18K gold strikes a balance between durability and purity, making it popular for both jewelry and engagement rings.

- 14K – This alloy contains 58.3% pure gold and is widely used in the United States for its strength and affordability.

- 10K – The lowest purity level that can still be classified as gold, containing 41.7% pure gold, often used in more affordable jewelry options.

When evaluating gold jewelry, the karat weight plays a significant role in its market value. Higher karat pieces typically command higher prices due to their greater gold content. For instance, a 24K gold necklace will generally be more expensive than a 14K gold bracelet, even if the designs are similar. This is because buyers are willing to pay a premium for the purity and intrinsic value of the gold.

Moreover, the market demand for gold can fluctuate based on economic conditions, affecting the resale value of gold jewelry. In times of economic uncertainty, gold is often viewed as a safe investment, leading to increased demand and higher prices. Collectors should keep abreast of these trends to maximize their investments.

In addition to purity, the craftsmanship and design of the jewelry piece also contribute to its overall value. For example, a beautifully crafted 18K gold ring from a renowned designer may fetch a higher price than a plain 24K gold band due to its artistic value and brand recognition. Thus, collectors should consider not only the purity but also the design and brand of gold jewelry when making purchases.

Another important aspect to consider is the care and maintenance of gold jewelry. Higher karat gold, such as 22K and 24K, is more malleable and prone to scratching compared to lower karat options. Therefore, proper care is essential to maintain the piece’s beauty and value over time. Regular cleaning with a soft cloth and storing jewelry in a safe place can help preserve its condition.

In conclusion, understanding gold purity is vital for collectors and investors in the jewelry market. By recognizing the significance of karat weight, market demand, and the quality of craftsmanship, individuals can make well-informed decisions that align with their investment goals. Whether purchasing gold jewelry for personal enjoyment or as a financial asset, knowledge of gold purity will undoubtedly enhance the experience.

High-End Watches: A Blend of Function and Fashion

Luxury watches have long been revered not just for their exquisite craftsmanship, but also for their potential to appreciate in value over time. As both functional items and investment pieces, high-end watches from renowned brands represent a unique blend of functionality and fashion. This article delves into the key aspects of investing in luxury watches, providing insights into why they are a wise choice for collectors and enthusiasts alike.

Many collectors view luxury watches as more than mere timepieces; they are strategic investments. The market for high-end watches has shown a consistent trend of appreciation, particularly for models from iconic brands. Factors such as rarity, brand reputation, and condition play significant roles in determining a watch’s value.

- Brand Reputation: Brands like Rolex and Patek Philippe have established a legacy of quality and prestige, which contributes to their watches’ desirability.

- Limited Editions: Many luxury watches are produced in limited quantities, creating a sense of exclusivity that drives up demand.

- Condition and Provenance: The state of a watch and its history can greatly influence its market value. Well-maintained pieces with documented provenance tend to fetch higher prices.

When considering luxury watches as investments, it’s crucial to focus on reputable brands known for their quality and market performance. Rolex, for example, is synonymous with luxury and has a robust resale market. Similarly, Patek Philippe is renowned for its exceptional craftsmanship and often sees significant price appreciation over time.

Understanding the various factors that influence watch value can guide collectors in making informed decisions. Key considerations include:

- Condition: A watch in excellent condition will typically command a higher price than one that shows signs of wear.

- Rarity: Limited production runs or unique features can make certain models highly sought after.

- Market Trends: Keeping an eye on industry trends and auction results can provide insights into which models are gaining popularity.

To preserve the value of luxury watches, proper maintenance is essential. Here are some tips for keeping your timepiece in top condition:

1. Regular servicing by a qualified professional.2. Avoid exposure to extreme temperatures and magnetic fields.3. Store watches in a cool, dry place, ideally in a watch box.4. Clean the watch case and bracelet regularly with a soft cloth.

Investing in luxury watches can be an exciting venture, but it requires careful planning and research. Collectors are encouraged to focus on building a diverse collection that includes various brands and styles. This diversity not only enhances the aesthetic appeal of a collection but also mitigates risk.

Luxury watches are more than just instruments for telling time; they are valuable assets that can appreciate significantly over the years. By understanding the factors that contribute to their value and focusing on reputable brands, collectors can make informed investment decisions. With proper care and attention, high-end watches can serve as both functional pieces and lucrative investments.

Key Brands to Watch For

When it comes to investing in luxury watches, brand reputation plays a pivotal role in determining the value and desirability of a timepiece. Certain brands, such as Rolex and Patek Philippe, have established themselves as leaders in the luxury watch market, often leading to higher resale values. But what exactly makes these brands stand out?

The enduring value of Rolex and Patek Philippe can be attributed to several factors:

- Heritage and Craftsmanship: Both brands boast a rich history and are renowned for their exceptional craftsmanship. Rolex has been producing watches since 1905, while Patek Philippe has a legacy dating back to 1839.

- Rarity: Limited production runs and exclusive models contribute to the scarcity of these watches, making them highly sought after by collectors.

- Brand Prestige: The prestige associated with owning a Rolex or Patek Philippe enhances their desirability, often transforming them into status symbols.

Understanding market trends is crucial for anyone looking to invest in high-end watches. For instance, the popularity of vintage models has surged in recent years, leading to significant price increases. Collectors are now paying top dollar for models that were once considered less desirable.

Several key factors can significantly affect the resale value of luxury watches:

- Condition: The condition of the watch is paramount. Watches that have been well-maintained, with original parts and minimal wear, command higher prices.

- Provenance: A watch with a documented history or previous ownership by a celebrity can fetch a premium.

- Market Demand: Trends in consumer preferences can shift, affecting which models are in demand at any given time.

While Rolex and Patek Philippe are often at the forefront, several other brands also hold their value exceptionally well:

- Audemars Piguet: Known for its Royal Oak collection, this brand combines innovative design with luxury.

- Omega: With a strong heritage in space exploration and sports timekeeping, Omega watches are both collectible and practical.

- Tag Heuer: This brand is popular for its sporty designs and has a strong presence in the automotive industry.

When investing in luxury watches, ensuring authenticity is crucial. Counterfeit watches can flood the market, and it’s essential to purchase from reputable dealers or obtain certificates of authenticity. Understanding the nuances of each brand can help buyers avoid pitfalls.

Investing in luxury watches can be a rewarding venture, provided that buyers conduct thorough research and understand the factors influencing value. Watches from reputable brands like Rolex and Patek Philippe often appreciate over time, making them not just a fashion statement but also a wise financial decision.

In summary, the luxury watch market is not just about telling time; it’s about investing in pieces that can hold or even increase their value over time. By focusing on key brands and understanding market dynamics, collectors can make informed decisions that enhance their collections and financial portfolios.

Factors Affecting Watch Value

When it comes to investing in luxury watches, understanding the factors affecting their value is essential for collectors and enthusiasts alike. The intricate world of horology is influenced by various elements that can significantly impact the desirability and market price of a timepiece. Below, we delve into the key factors that play a crucial role in determining watch value.

The condition of a watch is one of the most critical aspects influencing its value. Watches that are in excellent condition with minimal wear and tear are generally more sought after. Collectors often prefer pieces with original parts and minimal modifications. Additionally, the presence of the original box and papers can enhance a watch’s appeal and value significantly.

Rarity plays a vital role in determining a watch’s market value. Limited edition pieces or those produced in small quantities tend to be more desirable among collectors. Brands like Rolex and Patek Philippe often release limited models that can appreciate significantly over time. The fewer the pieces available, the higher the demand, which ultimately drives up the price.

The provenance of a watch refers to its history and prior ownership. Watches that have a fascinating story or a notable previous owner can command higher prices. For instance, a watch once owned by a celebrity or a historical figure can add a layer of desirability that significantly impacts its value. Collectors often seek pieces with a documented history, as it adds to the watch’s allure.

The reputation of the brand is another crucial factor in watch valuation. Renowned brands such as Rolex, Patek Philippe, and Audemars Piguet are synonymous with luxury and craftsmanship. Watches from these brands typically maintain their value better than lesser-known brands. The brand’s history, craftsmanship, and innovation contribute to its market standing, making it an essential consideration for investors.

Market trends can greatly influence the value of luxury watches. Staying informed about the latest trends in the watch market can help collectors make strategic decisions. For instance, certain styles or features may become popular, leading to increased demand for specific models. Understanding these trends can help investors identify the right time to buy or sell a watch.

The materials used in a watch’s construction, such as gold, platinum, or ceramic, can also affect its value. High-quality craftsmanship and innovative features, such as in-house movements or unique complications, can make a watch more appealing to collectors. The overall quality of materials and craftsmanship can significantly enhance a watch’s market value.

The age of a watch can contribute to its value, especially in the case of vintage models. Certain watches become more desirable as they age, particularly if they are well-preserved and represent a significant era in watchmaking. Collectors often seek out vintage pieces that reflect historical significance or unique design characteristics.

Finally, the overall demand for a specific model or brand can impact its value. A watch that is highly sought after by collectors will typically command a higher price. Understanding the dynamics of collector interest and market demand can provide valuable insights for potential investors.

In conclusion, appreciating the various factors that influence watch value—such as condition, rarity, provenance, brand reputation, market trends, materials, age, and demand—can empower collectors to make informed investment decisions. By considering these elements, enthusiasts can navigate the intricate world of luxury watches and build a collection that stands the test of time.

Fine Pearl Jewelry: A Unique Investment

Fine pearl jewelry represents a captivating blend of natural beauty and significant investment potential. Natural pearls, which are formed without human intervention, are exceedingly rare and often command high prices at auctions. On the other hand, high-quality cultured pearls have also gained recognition for their allure and value among discerning collectors.

Investing in fine pearls can be a rewarding experience for several reasons:

- Rarity: Natural pearls are incredibly rare, making them highly sought after. Their scarcity contributes to their high market value.

- Timeless Elegance: Pearls have been cherished for centuries, symbolizing sophistication and grace, which adds to their enduring appeal.

- Versatility: Pearl jewelry can be worn on various occasions, from casual outings to formal events, making them a versatile addition to any jewelry collection.

When considering an investment in pearls, it is essential to focus on specific types that are known for their value:

- Akoya Pearls: Renowned for their luster and round shape, Akoya pearls are often used in classic pearl necklaces.

- South Sea Pearls: These pearls are among the largest and most valuable, known for their rich colors and thick nacre.

- Tahitian Pearls: Famous for their unique dark hues, Tahitian pearls are increasingly popular among collectors.

The value of pearl jewelry is determined by several key factors:

- Size: Larger pearls generally have a higher value due to their rarity.

- Luster: The quality of the pearl’s surface sheen is crucial; pearls with a high luster are more desirable.

- Shape: Round pearls are the most valuable, while irregular shapes may be less sought after.

- Color: The color of the pearl can significantly impact its value, with certain hues being more desirable in specific markets.

To preserve the beauty and value of pearl jewelry, proper care is essential:

- Avoid Chemicals: Keep pearls away from perfumes, cosmetics, and household cleaners, as these can damage their surface.

- Regular Cleaning: Wipe pearls with a soft cloth after wearing to remove oils and dirt.

- Storage: Store pearls separately in a soft pouch to prevent scratches from other jewelry.

The market for fine pearls is evolving, with increasing interest from collectors and investors. As more people recognize the value of fine pearl jewelry, demand is likely to grow, potentially leading to appreciation in value over time. Monitoring market trends and understanding consumer preferences can provide insights into when to buy or sell pearl jewelry.

In summary, investing in fine pearl jewelry can be a unique and rewarding venture. With their rarity, timeless elegance, and the right care, pearls can not only enhance your jewelry collection but also serve as a valuable asset that appreciates over time.

Types of Pearls to Invest In

When it comes to investing in fine jewelry, pearls stand out as a unique and elegant option. Among the various types of pearls available, three specific categories have gained prominence among investors: Akoya, South Sea, and Tahitian pearls. Each type possesses distinct characteristics that not only contribute to their beauty but also significantly influence their market value.

Pearls are often regarded as a classic choice in luxury jewelry, and their investment potential is growing. Unlike other gemstones, pearls are organic and have a unique charm that appeals to collectors and investors alike. Their value is determined by factors such as size, luster, surface quality, and color. Understanding the nuances of each pearl type can help investors make informed decisions.

Akoya pearls are known for their high luster and round shape, making them a popular choice for classic pearl jewelry. Cultivated mainly in Japan, these pearls typically range from 2mm to 10mm in size. The most sought-after Akoya pearls are those with a mirror-like luster and minimal blemishes. Their timeless appeal makes them a staple in many jewelry collections, and they often retain their value well.

South Sea pearls are among the largest and most valuable pearls available, often exceeding 10mm in diameter. These pearls are primarily produced in Australia, Indonesia, and the Philippines and come in a variety of colors, including white, silver, and gold. The rarity of South Sea pearls, combined with their stunning size and luster, makes them a top choice for investors looking for pieces that appreciate in value over time. The golden South Sea pearls, in particular, are highly coveted and can command premium prices in the market.

Tahitian pearls, often referred to as “black pearls,” are cultivated in the warm waters of French Polynesia. Their unique colors, ranging from dark gray to vibrant green and peacock hues, set them apart from other pearl types. The iridescence and unique color variations of Tahitian pearls make them highly desirable among collectors. Their larger size and distinctive appearance contribute to their overall value, making them an excellent investment option.

| Pearl Type | Size Range | Color Variations | Market Value |

|---|---|---|---|

| Akoya | 2mm – 10mm | White, Cream | Moderate to High |

| South Sea | 10mm and above | White, Silver, Gold | High to Very High |

| Tahitian | 8mm – 18mm | Black, Green, Peacock | High |

Investors should keep an eye on market trends when considering pearl investments. The demand for high-quality pearls has seen a resurgence, largely due to their versatility and timeless elegance. As fashion trends evolve, the appreciation for unique and exotic pearls like South Sea and Tahitian has grown. This trend indicates a promising future for pearl investments, as collectors seek distinctive pieces that stand out.

Proper care is essential for maintaining the beauty and value of pearl jewelry. Pearls are sensitive to chemicals, so it is crucial to avoid exposure to perfumes, lotions, and cleaning agents. Regular cleaning with a soft cloth and storing pearls in a separate, soft pouch can help preserve their luster. By taking care of these exquisite gems, investors can ensure their pieces remain valuable over time.

Care and Maintenance of Pearl Jewelry

Pearl jewelry is not only a symbol of elegance but also a significant investment that requires proper care to maintain its beauty and value over time. Unlike other gemstones, pearls are organic and sensitive to various environmental factors. Understanding how to care for them can help ensure they remain stunning and retain their worth.

Proper maintenance of pearl jewelry is essential because pearls are made of calcium carbonate, which can be easily damaged by harsh chemicals, moisture, and even body oils. Neglecting their care can lead to discoloration, loss of luster, and ultimately a decrease in value.

- Avoid Contact with Chemicals: Always remove pearl jewelry before applying perfumes, lotions, or hair products. Chemicals can dull the surface and affect their shine.

- Store Properly: Store pearls separately in a soft cloth or a dedicated jewelry box to prevent scratches from other pieces.

- Wear Often: Surprisingly, wearing pearls can actually keep them looking their best. The natural oils from your skin help to maintain their luster.

Regular cleaning is vital for pearl maintenance. Here’s how to do it safely:

1. Use a soft, damp cloth to wipe each pearl after wearing.2. For deeper cleaning, mix a few drops of mild soap in water.3. Dip a soft cloth in the solution and gently wipe the pearls.4. Rinse with clean water and dry with a soft cloth.

While regular care is essential, consider having your pearl jewelry checked by a professional jeweler every few years. They can assess the condition of the pearls, re-string them if necessary, and provide specialized cleaning that can restore their original beauty.

Being aware of the signs of damage can help you take action before it’s too late:

- Loss of Luster: If your pearls appear dull or lack their usual shine, it may be time for a professional cleaning.

- Cracks or Chips: Inspect your pearls regularly for any visible damage. If you notice any, consult a jeweler immediately.

- Loose or Frayed String: If the string holding your pearls appears worn, it’s crucial to have it re-strung to prevent loss.

For those who own high-quality or vintage pearl pieces, consider these long-term care strategies:

- Limit Exposure to Heat: Keep pearls away from direct sunlight and heat sources, as extreme temperatures can cause them to dry out and crack.

- Regularly Rotate Your Collection: If you have multiple pieces, rotating their wear can help prevent uneven wear and tear.

- Insurance and Appraisal: Consider insuring your pearl jewelry and getting regular appraisals to keep track of their value.

By following these care and maintenance tips, you can ensure that your pearl jewelry remains a beautiful and valuable addition to your collection for years to come. Investing time in their upkeep is not just beneficial; it’s essential for preserving their allure and worth.

Emeralds: The Green Gemstone

Emeralds are not just visually captivating; they are also increasingly recognized as valuable assets in the world of luxury jewelry. Their unique green hue, coupled with their rarity, makes them a coveted choice for collectors and investors alike. In this section, we will explore the characteristics that contribute to the value of emeralds, current market trends, and tips for investing in these stunning gemstones.

Emeralds are esteemed not only for their beauty but also for their historical significance and cultural associations. Often referred to as the “gem of love,” emeralds have been cherished since ancient times, symbolizing rebirth and fertility. Their deep green color, caused by trace amounts of chromium and vanadium, is a key factor in their desirability.

When assessing the value of emeralds, several factors come into play:

- Color: The most prized emeralds exhibit a vivid green hue, with a slight bluish tint being highly desirable.

- Clarity: Unlike diamonds, emeralds often contain inclusions, which can affect their value. However, less clarity can sometimes enhance their character.

- Cut: The way an emerald is cut can influence its brilliance and overall appearance. Common cuts include oval, pear, and cushion shapes.

- Carat Weight: Larger emeralds are rarer and, therefore, more valuable. However, quality should always be prioritized over size.

Understanding current trends in the emerald market can aid investors in making informed decisions. Recently, the demand for high-quality emeralds has surged, particularly in emerging markets. This rising interest is fueled by the increasing popularity of colored gemstones among younger consumers, who are seeking alternatives to traditional diamond engagement rings.

Additionally, the sustainability movement has prompted buyers to consider ethically sourced emeralds. Many consumers now prefer gemstones that are responsibly mined, which can enhance their value and appeal.

Investing in emeralds requires careful consideration. Here are some practical tips:

- Research Reputable Dealers: Always purchase from established jewelers or auction houses with a track record of authenticity.

- Request Certification: Look for emeralds that come with a certification from a recognized gemological laboratory, which verifies their quality and authenticity.

- Consider Long-Term Value: While emeralds can be a significant investment, their value can fluctuate based on market conditions. It’s essential to view them as long-term assets.

While emeralds are highly sought after, they are often compared to other gemstones like sapphires and rubies. Each has its unique characteristics and market dynamics. However, emeralds stand out due to their distinctive color and historical allure. Investing in emeralds can provide a diversified portfolio for jewelry collectors, as they often appreciate in value over time.

In summary, emeralds are not only stunning but also increasingly sought after, making them a valuable addition to any jewelry collection. With their rich history, unique qualities, and growing market demand, emeralds represent both an aesthetic delight and a smart investment opportunity.

Evaluating Emerald Quality

When it comes to investing in emeralds, understanding how to evaluate their quality is paramount. Emeralds, known for their striking green hues, are not only beautiful but also carry significant value in the jewelry market. The quality assessment of emeralds hinges on several critical factors, including color, clarity, cut, and carat weight. Each of these elements plays a vital role in determining the overall market value of the gemstone.

The color of an emerald is often considered the most crucial factor in its quality assessment. The most desirable emeralds exhibit a vibrant, deep green hue, often described as “jewel green.” Factors such as tone and saturation also influence the overall appearance. Emeralds with a rich, vivid color are typically more valuable, while those with a lighter or overly dark color may not command the same market price.

Clarity refers to the presence of inclusions or blemishes within the emerald. Unlike diamonds, emeralds are often expected to have some inclusions, known as “jardin,” which can add character to the stone. However, the fewer inclusions an emerald has, the more valuable it tends to be. Clarity is graded on a scale, and higher clarity grades can significantly enhance the stone’s marketability.

The cut of an emerald is essential for maximizing its beauty and brilliance. Unlike diamonds, emeralds are typically cut in a rectangular shape known as an “emerald cut,” which helps to showcase their color while minimizing the visibility of inclusions. A well-executed cut can enhance the stone’s overall appearance. Buyers should look for symmetry and proportion in the cut, as these factors contribute to the stone’s aesthetic appeal.

Carat weight is another critical factor in evaluating emerald quality. Larger emeralds are rarer and more sought after, which often translates to higher prices. However, it is essential to balance carat weight with the other quality factors. A smaller emerald with exceptional color and clarity can be more valuable than a larger stone with poor quality attributes.

It is also crucial to consider that many emeralds undergo treatments to enhance their appearance. Oiling is a common practice that can improve clarity and color. While treated emeralds can be beautiful, they may not hold the same value as untreated stones. Buyers should always inquire about any treatments performed on an emerald to ensure they understand its true value.

Staying informed about the latest market trends can help investors gauge the potential for price appreciation in emerald jewelry. Factors such as demand, global economic conditions, and the popularity of colored gemstones can significantly influence market values. Regularly monitoring these trends can provide valuable insights for both collectors and investors.

In summary, evaluating emerald quality requires a comprehensive understanding of color, clarity, cut, and carat weight. By paying attention to these factors, buyers can make informed decisions that not only enhance their collections but also serve as wise investments in the luxury jewelry market.

Emerald Market Trends

Emeralds, with their captivating green hue and rich history, have become increasingly popular among collectors and investors. As a gemstone that signifies luxury and status, understanding the current market trends for emeralds is essential for anyone looking to invest in this stunning gem.

Emeralds are not only beautiful but also possess unique qualities that make them a wise investment choice. Their rarity, especially in high-quality stones, contributes to their value appreciation over time. Unlike diamonds and gold, emeralds have a distinct charm and appeal that resonates with buyers, making them a desirable asset in the luxury market.

The value of emeralds is primarily determined by four key factors: color, clarity, cut, and carat weight. Among these, the color is the most significant. Vivid green emeralds with minimal inclusions are generally more sought after and command higher prices. Understanding these factors can help investors make informed decisions when purchasing emerald jewelry.

Staying informed about market trends can help investors gauge the potential for price appreciation in emerald jewelry. The demand for emeralds has surged in recent years, driven by a growing interest in colored gemstones. Factors influencing this trend include:

- Increased Consumer Demand: As more consumers seek unique and colorful alternatives to traditional diamonds, the market for emeralds has expanded.

- Celebrity Influence: High-profile celebrities often showcase emerald jewelry, further boosting its desirability and perceived value.

- Investment Diversification: Investors are increasingly looking to diversify their portfolios with gemstones, including emeralds, which can provide a hedge against market volatility.

While diamonds and sapphires have long been the go-to investments in the gemstone market, emeralds are gaining traction. Their unique aesthetic appeal and the emotional connection they evoke make them an attractive alternative. Investors should consider how emeralds fit into their overall investment strategy, especially in comparison to more traditional options.

As the global market continues to evolve, the outlook for emeralds remains positive. With their limited supply and growing demand, emeralds are poised for potential price appreciation. Additionally, advancements in mining and sourcing practices are likely to enhance the quality and availability of emeralds, further solidifying their status as a valuable investment.

Investing in emeralds requires a keen understanding of market trends and quality factors. By staying informed and making educated choices, investors can successfully navigate the emerald market and potentially reap significant rewards. Whether you are a seasoned collector or a new investor, emeralds offer a unique opportunity to enhance your jewelry collection and investment portfolio.

Antique and Vintage Jewelry: A Historical Perspective

Antique and vintage jewelry pieces are not merely decorative items; they are windows into the past, often carrying rich historical significance that enhances their value. Investing in these pieces can be a rewarding journey, as they often appreciate over time due to their unique stories, craftsmanship, and rarity.

What distinguishes antique and vintage jewelry from modern pieces? Generally, antique jewelry refers to items that are over 100 years old, while vintage jewelry is typically defined as pieces that are at least 20 years old but less than 100. Both categories offer a fascinating glimpse into the artistic trends, societal norms, and technological advancements of their respective eras.

One of the most compelling reasons to invest in antique and vintage jewelry is their historical significance. Many pieces are associated with notable events, cultural movements, or famous individuals, which can greatly enhance their appeal and market value. For instance, jewelry from the Art Deco period is celebrated for its geometric designs and luxurious materials, making it highly sought after by collectors and investors alike.

Investors should also consider the craftsmanship involved in creating these pieces. Unlike mass-produced jewelry, antique and vintage items often feature intricate details and techniques that are no longer widely practiced. This level of artistry can significantly contribute to a piece’s value, as the rarity of skilled craftsmanship becomes increasingly apparent.

- Research and Documentation: Understanding the provenance of a piece can help establish its authenticity and historical context.

- Condition and Restoration: The condition of antique jewelry can greatly affect its value. Professional restoration can enhance a piece’s appeal but should be done carefully to maintain its integrity.

- Market Demand: Keeping an eye on current trends in the antique jewelry market can provide insight into which pieces are likely to appreciate in value.

Additionally, the appeal of vintage styles cannot be overstated. Many collectors are drawn to specific design trends that reflect the aesthetics of their time. For example, Victorian jewelry is known for its sentimental motifs, while Mid-Century Modern pieces often showcase bold colors and innovative designs. This variety allows collectors to curate a diverse collection that resonates with personal taste while also offering investment potential.

When considering an investment in antique or vintage jewelry, it is crucial to educate oneself about the market dynamics. Factors such as rarity, demand, and condition can significantly influence a piece’s value. Engaging with reputable dealers, attending auctions, and participating in antique shows can provide valuable insights and opportunities for acquiring high-quality items.

Moreover, the emotional connection that often accompanies antique and vintage jewelry can enhance its value beyond mere monetary terms. Each piece tells a story, and owning such an item can provide a sense of continuity and connection to history that resonates with many collectors.

In conclusion, antique and vintage jewelry offers a unique investment opportunity that combines aesthetic appeal with historical significance. By understanding the factors that contribute to their value, collectors can make informed decisions and enjoy the dual benefits of owning beautiful pieces while also investing in items that may appreciate over time. Whether you are a seasoned collector or a newcomer to the world of vintage jewelry, there is always something new to discover and appreciate.

Identifying Authentic Antique Jewelry

When it comes to collecting antique jewelry, understanding how to identify authentic pieces is crucial for any collector. The world of antique jewelry is rich with history and artistry, but it is also fraught with the risk of encountering counterfeit items. Knowing how to distinguish genuine antique jewelry from replicas or modern fakes can significantly enhance your collection and protect your investment.

For collectors, the value of antique jewelry often lies not only in its aesthetic appeal but also in its historical significance. Authentic pieces can appreciate over time, making them valuable investments. In contrast, counterfeit jewelry can lead to financial loss and disappointment. Thus, understanding the characteristics of genuine antique jewelry is essential.

- Materials Used: Authentic antique jewelry is typically made from high-quality materials such as gold, silver, or platinum. Look for stamps or hallmarks that indicate the metal’s purity.

- Craftsmanship: Examine the craftsmanship closely. Genuine antique pieces often exhibit intricate details and superior craftsmanship that are difficult to replicate.

- Patina: Over time, authentic pieces develop a natural patina that adds to their charm. This aging process is difficult to mimic in modern reproductions.

- Gemstones: Antique jewelry often features natural gemstones rather than synthetic ones. Understanding the properties of these stones can help in identification.

To ensure that you are purchasing genuine antique jewelry, consider the following methods:

- Research Provenance: Investigate the history of the piece. Documentation, previous ownership, and historical context can provide valuable insights.

- Consult Experts: Seek the opinion of a certified appraiser or a reputable antique jewelry dealer. Their expertise can help confirm the authenticity of a piece.

- Use Technology: Tools like gemological microscopes can reveal details that are invisible to the naked eye, aiding in the identification process.

Even seasoned collectors can fall prey to counterfeits. Here are some common pitfalls to be aware of:

- Overly Polished Pieces: If a piece looks too new or overly polished, it may not be authentic. Genuine antiques often show signs of wear and age.

- Unverified Sellers: Always purchase from reputable dealers to minimize the risk of acquiring counterfeit items.

- Ignoring Documentation: Authentic antique jewelry often comes with documentation or certificates. Always ask for these when making a purchase.

Identifying authentic antique jewelry requires a keen eye and a bit of knowledge. By understanding the key characteristics, verifying authenticity through research and expert consultation, and avoiding common pitfalls, collectors can build a valuable and genuine collection. The allure of antique jewelry lies not only in its beauty but also in the stories it tells, making it a rewarding pursuit for any enthusiast.

The Appeal of Vintage Styles

Vintage jewelry is more than just an accessory; it is a tangible piece of history that encapsulates the artistry and craftsmanship of its time. As fashion trends evolve, vintage pieces often reflect unique design styles that are distinct to specific eras, making them highly sought after by collectors and enthusiasts alike. This appeal not only enhances their desirability but also significantly contributes to their value in the marketplace.

The allure of vintage jewelry lies in its exclusivity and the stories it tells. Unlike contemporary pieces, which are mass-produced, vintage jewelry is often limited in availability. This scarcity can drive demand, especially for items crafted by renowned designers or those that feature unique materials. Additionally, the craftsmanship found in vintage pieces often surpasses many modern creations, showcasing intricate details and techniques that are less common today.

- Art Deco: Known for its geometric shapes and bold colors, Art Deco jewelry remains a favorite for its elegance and sophistication.

- Victorian: This era is characterized by romantic designs, often featuring intricate metalwork and the use of gemstones.

- Edwardian: Renowned for its delicate filigree work and use of platinum, Edwardian jewelry often includes pearls and diamonds.

- Retro: Reflecting the glamour of the 1940s and 50s, Retro jewelry often features larger, bolder designs and vibrant gemstones.

The craftsmanship of vintage jewelry plays a crucial role in determining its value. Pieces that showcase exceptional skill, such as hand-engraving or unique setting techniques, are often more desirable. Collectors appreciate the time and effort that went into creating these pieces, which can lead to higher market values. Furthermore, items with a well-documented provenance or history can command premium prices.

While investing in vintage jewelry can be rewarding, it is not without risks. Counterfeit pieces and reproductions can flood the market, making it essential for buyers to conduct thorough research and seek expert opinions. Additionally, fluctuations in market demand can affect the resale value of vintage items. It’s important for potential investors to stay informed about market trends and to buy from reputable dealers.

Proper care is essential to maintain the beauty and integrity of vintage jewelry. Here are some tips:

- Storage: Store pieces in a cool, dry place, ideally in a soft pouch or lined box to prevent scratches.

- Cleansing: Use gentle cleaning methods. Avoid harsh chemicals that can damage delicate materials.

- Regular Inspections: Periodically check for loose stones or signs of wear, and seek professional repairs when needed.

Investing in vintage jewelry not only allows collectors to enjoy beautiful pieces but also offers potential financial returns. As the demand for unique and historical items continues to grow, the value of well-preserved vintage jewelry is likely to appreciate over time. This combination of aesthetic pleasure and potential profit makes vintage jewelry a compelling addition to any collection.

Investment-Grade Colored Gemstones

Investment-grade colored gemstones have become increasingly popular among collectors and investors alike, primarily due to their rarity and beauty. Unlike traditional investments such as stocks or bonds, these gemstones offer a unique blend of aesthetic appeal and financial potential. This article delves into the world of colored gemstones, particularly focusing on sapphires, rubies, and other valuable stones that are catching the eye of savvy investors.

Investing in colored gemstones can be a lucrative decision for several reasons:

- Rarity: Many colored gemstones are significantly rarer than diamonds, making them more valuable and sought after.

- Market Demand: As more people become aware of the beauty and investment potential of colored gems, demand continues to rise.

- Portability: Unlike real estate or large investments, gemstones are easy to transport and store.

Several colored gemstones have shown a consistent history of price appreciation, making them appealing options for investors. Here are some of the most popular:

- Sapphires: Known for their stunning blue hues, sapphires are among the most valuable colored gemstones. The best quality sapphires can fetch high prices, especially those with a deep, vivid blue color.

- Rubies: Often referred to as the “king of gemstones,” rubies are highly prized for their rich red color. High-quality rubies, particularly those from Burma, can command astronomical prices in the market.

- Emeralds: With their vibrant green color, emeralds are not only beautiful but also increasingly sought after. The finest emeralds exhibit a deep green color with minimal inclusions, making them valuable investments.

- Fancy Color Diamonds: While technically diamonds, fancy color diamonds in hues like pink, blue, and yellow have gained popularity due to their unique colors and rarity.

When investing in colored gemstones, understanding the factors that affect their quality and value is crucial:

- Color: The most important factor. Intense, vibrant colors are generally more valuable.

- Clarity: Fewer inclusions and blemishes typically result in a higher value.

- Cut: The quality of the cut affects how light interacts with the gemstone, impacting its overall appearance.

- Carat Weight: Larger stones are rarer and often more valuable, but the other factors must also be considered.

Understanding the market dynamics for colored gemstones can significantly impact investment decisions:

- Trends: Stay informed about the latest trends in colored gemstones, as styles and preferences can shift.

- Authentication: Ensure that gemstones come with proper certification from reputable gemological laboratories to verify their quality.

- Investment Horizon: Consider your investment timeline; colored gemstones can take time to appreciate in value.

Investors should seek reputable sources when purchasing colored gemstones. Options include:

- Specialized Jewelers: Look for jewelers who specialize in colored gemstones and can provide certification and history.

- Auction Houses: High-end auction houses often feature rare and valuable gemstones.

- Gem Shows: Attending gem and mineral shows can provide opportunities to buy directly from dealers.

In conclusion, investment-grade colored gemstones represent a fascinating blend of beauty and financial opportunity. As their popularity continues to rise, understanding their unique qualities and market dynamics can help investors make informed decisions that enhance their collections and portfolios.

Popular Investment Gemstones

When it comes to investing in jewelry, colored gemstones are increasingly recognized as valuable assets. Unlike traditional investments, colored gemstones offer a unique blend of beauty and potential for price appreciation, making them appealing options for both seasoned investors and newcomers to the market.

Colored gemstones, such as rubies, sapphires, and emeralds, possess a natural allure that goes beyond their aesthetic appeal. Their value is influenced by several factors, including rarity, demand, and market trends. As collectors seek to diversify their portfolios, these gemstones present an attractive alternative to traditional investments.

The rarity of a gemstone plays a critical role in its investment potential. For example, Padparadscha sapphires and red diamonds are incredibly rare, leading to higher value appreciation over time. Additionally, the demand for certain gemstones can fluctuate based on fashion trends and cultural significance, affecting their market value.

Investors should be familiar with the quality factors that determine the value of colored gemstones. These include:

- Color: The hue, tone, and saturation significantly impact value.

- Clarity: Fewer inclusions lead to higher quality and price.

- Cut: A well-cut gemstone maximizes brilliance and overall appeal.

- Carat weight: Larger stones are generally more valuable, but quality should not be compromised for size.

Staying informed about market trends is essential for investors. Over the past few years, certain colored gemstones have shown a consistent increase in value. For instance, the demand for vintage and antique colored gemstones has surged, driven by collectors’ desire for unique pieces.

Some colored gemstones have established themselves as reliable investment options:

1. Rubies: Known as the "king of gemstones," rubies are prized for their vibrant red color and rarity.2. Sapphires: Available in various colors, blue sapphires are particularly sought after, with strong demand driving prices up.3. Emeralds: Their deep green hue and historical significance make emeralds a favorite among collectors.4. Alexandrite: This rare color-changing gemstone has gained popularity, making it a smart investment choice.5. Paraiba Tourmaline: Known for its electric blue color, this gemstone is increasingly sought after and can command high prices.

When investing in colored gemstones, consider the following strategies:

- Research: Understand the market and seek expert advice to make informed decisions.

- Buy Quality: Prioritize gemstones with high quality and provenance to ensure value retention.

- Diversify: Consider a variety of gemstones to spread risk and increase potential returns.

Investing in colored gemstones offers a unique opportunity to combine passion with financial strategy. By understanding the factors that influence value and staying informed about market trends, investors can make educated decisions that enhance their collections while potentially yielding significant returns.

Market Insights for Colored Gemstones

Investing in colored gemstones has become increasingly popular among collectors and investors alike. Understanding the market dynamics and demand for these stunning stones is essential for making informed purchasing decisions. In this section, we will delve into the factors that influence the value of colored gemstones and provide insights into how investors can navigate this vibrant market.

The demand for colored gemstones is driven by several key factors:

- Rarity: Many colored gemstones, such as padparadscha sapphires and fine-quality emeralds, are rare, which makes them more desirable to collectors.

- Beauty: The aesthetic appeal of colored gemstones, with their vibrant hues and unique characteristics, attracts buyers looking for distinctive jewelry pieces.

- Investment Potential: As more investors recognize the potential for price appreciation, the demand for high-quality colored gemstones has surged.

When investing in colored gemstones, it is crucial to evaluate their quality based on several criteria:

- Color: The most critical factor, with the most valuable stones exhibiting deep, vivid colors.

- Clarity: Fewer inclusions typically lead to higher value; however, some stones, like emeralds, may have inclusions that are accepted as part of their character.

- Cut: A well-executed cut enhances the stone’s brilliance and overall appearance, impacting its market value.

- Carat Weight: Larger stones are generally more valuable, but the quality of the stone must also be considered.

Keeping abreast of market trends is vital for investors:

- Emerging Markets: Countries like China and India show increasing demand for colored gemstones, influencing global prices.

- Online Sales: The rise of e-commerce platforms has made it easier for buyers to access rare gemstones, impacting market dynamics.

- Sustainability: Ethical sourcing and sustainability are becoming significant factors in purchasing decisions, creating demand for responsibly sourced gemstones.

To maximize investment potential, consider the following strategies:

- Diversification: Investing in a variety of gemstones can mitigate risk and enhance overall portfolio performance.

- Expert Appraisal: Always have gemstones appraised by certified professionals to ensure authenticity and value.

- Long-Term Perspective: Colored gemstones can appreciate over time, making them suitable for long-term investment strategies.

Understanding the market dynamics and demand for colored gemstones is essential for making strategic purchasing decisions. By evaluating quality, staying informed about market trends, and employing sound investment strategies, investors can navigate the colorful world of gemstones with confidence.

Custom and Designer Jewelry: Unique Value

When it comes to investing in jewelry, custom and designer pieces stand out for their unique attributes and potential for appreciation over time. These items are not just accessories; they are often regarded as works of art that encapsulate the vision of the designer and the craftsmanship involved in their creation. This article delves into the factors that contribute to the unique value of custom and designer jewelry, providing insights for potential investors and collectors.

Investing in custom and designer jewelry can be a savvy decision for several reasons:

- Craftsmanship: The meticulous attention to detail and quality of materials used in these pieces often sets them apart from mass-produced items.

- Brand Recognition: Renowned designers and brands carry a reputation that can significantly enhance the resale value of their pieces.

- Uniqueness: Custom pieces are often one-of-a-kind, making them more desirable to collectors and investors.

Understanding what contributes to the value of custom jewelry is essential for making informed investments. Here are key factors to consider:

- Materials Used: The type and quality of materials, such as precious metals and gemstones, greatly affect the overall value.

- Designer Reputation: Pieces created by established designers often appreciate more due to their brand’s prestige.

- Rarity: Limited edition or bespoke pieces can command higher prices due to their scarcity.

When selecting custom jewelry, it’s important to consider the following aspects:

- Research the Designer: Look for designers with a solid track record and positive reviews from previous clients.

- Understand the Market: Familiarize yourself with current trends and what types of custom pieces are gaining popularity.

- Request Documentation: Ensure that any custom piece comes with a certificate of authenticity and details about the materials used.

Investing in jewelry from reputable brands can yield significant returns. Some notable designer brands include:

- Tiffany & Co.: Known for its timeless designs and quality craftsmanship.

- Cartier: A brand synonymous with luxury and elegance.

- Bvlgari: Famous for its bold designs and high-quality gemstones.

To gauge the potential resale value of a custom piece, consider the following:

- Market Demand: Research current market trends to understand what types of custom jewelry are in demand.

- Condition: The condition of the piece plays a crucial role in its resale value; well-maintained items are more desirable.

- Provenance: A documented history of ownership can enhance the piece’s value.

Custom and designer jewelry pieces offer a unique investment opportunity due to their craftsmanship, brand recognition, and rarity. By understanding the factors that influence their value and making informed choices, investors can appreciate not only the beauty of these pieces but also their potential for long-term appreciation.

Choosing Reputable Designers

When it comes to investing in jewelry, one of the most significant factors to consider is the designer’s reputation. This is particularly true in the luxury market, where pieces from well-known designers can substantially enhance the resale value of jewelry. Understanding the nuances of designer jewelry can help investors make informed decisions and maximize their returns.

The luxury jewelry market is heavily influenced by brand recognition. Well-established designers often command higher prices for their pieces, primarily due to their history of quality and craftsmanship. Buyers are more inclined to invest in jewelry that comes with a prestigious name, as it often signifies exclusivity and superior quality.

- Research the Brand: Look into the designer’s history, their signature styles, and the materials they use. Brands with a long-standing reputation for quality are generally more desirable.

- Check for Authenticity: Ensure that the jewelry comes with proper documentation, such as certificates of authenticity, which can help verify its origin and value.

- Read Reviews: Customer and expert reviews can provide insights into the brand’s reliability and the quality of their pieces.

Investors should focus on both established luxury brands and emerging designers who have begun to gain recognition. Established brands like Cartier, Tiffany & Co., and Van Cleef & Arpels are known for their timeless designs and high resale values. On the other hand, emerging designers may offer unique pieces at lower prices, which could appreciate significantly over time as their reputation grows.

Custom jewelry can also hold significant value, particularly if it is crafted by a reputable designer. These pieces often reflect a unique vision and personal touch, making them not only valuable but also one-of-a-kind. However, understanding the factors that contribute to the value of custom pieces is essential:

- Craftsmanship: High-quality craftsmanship can significantly enhance the value of custom jewelry.

- Materials Used: The choice of materials, including precious metals and gemstones, will also impact the piece’s worth.

- Provenance: A well-documented history of the piece can add to its appeal and value.

When considering designer jewelry as an investment, it’s crucial to evaluate its investment potential. Factors to consider include:

- Market Demand: Assess the current market trends for specific designers and styles.

- Condition: The condition of the piece plays a vital role in its resale value. Well-maintained items are more likely to fetch higher prices.